2025 Form 1040 Schedule C Instructions. Profit or loss from business as a stand alone tax form calculator to quickly calculate. Profit or loss from business.

Using tax software simplifies the filing process even further. We show you how to complete and file your schedule c form (1040) using simple step by step instructions.

For The Latest Information About Developments Related To Schedule C And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Schedulec.

For example, if you file form 1040, you’ll record the amount of your expense on a dedicated line (24b) on schedule c.

If You Downloaded The 2023 Instructions For Schedule C (Form 1040) Prior To January 26,.

How to complete & file schedule c with your tax return;

Go To Line 32 Before Entering The Loss On Line 31.

Images References :

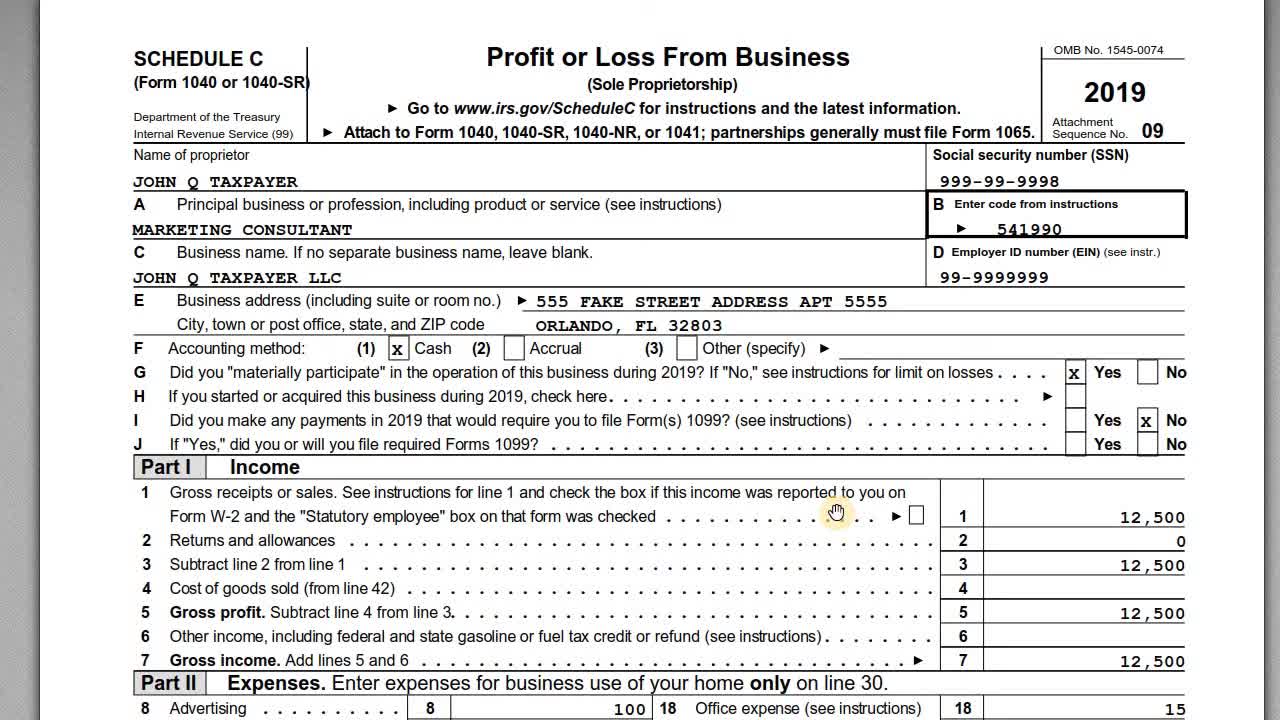

Source: theusualstuff.com

Source: theusualstuff.com

Schedule C Form 1040 How to Complete it? The Usual Stuff, Go to line 32 before entering the loss on line 31. The simplified method or detailed using form 8829 are specifically for the home.

Source: rumble.com

Source: rumble.com

IRS Schedule C with Form 1040 Self Employment Taxes, The simplified method or detailed using form 8829 are specifically for the home. Attach schedule c to your form 1040 tax return.

Source: portefoliomakeupbysofia.blogspot.com

Source: portefoliomakeupbysofia.blogspot.com

Irs 1040 Form C IRS Form 1040 Schedule C Download Fillable PDF or, To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Using tax software simplifies the filing process even further.

Source: www.pdffiller.com

Source: www.pdffiller.com

2015 Form IRS 1040 Schedule CEZ Fill Online, Printable, Fillable, Changes to the 2023 instructions for schedule c (form 1040) | internal revenue service. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more.

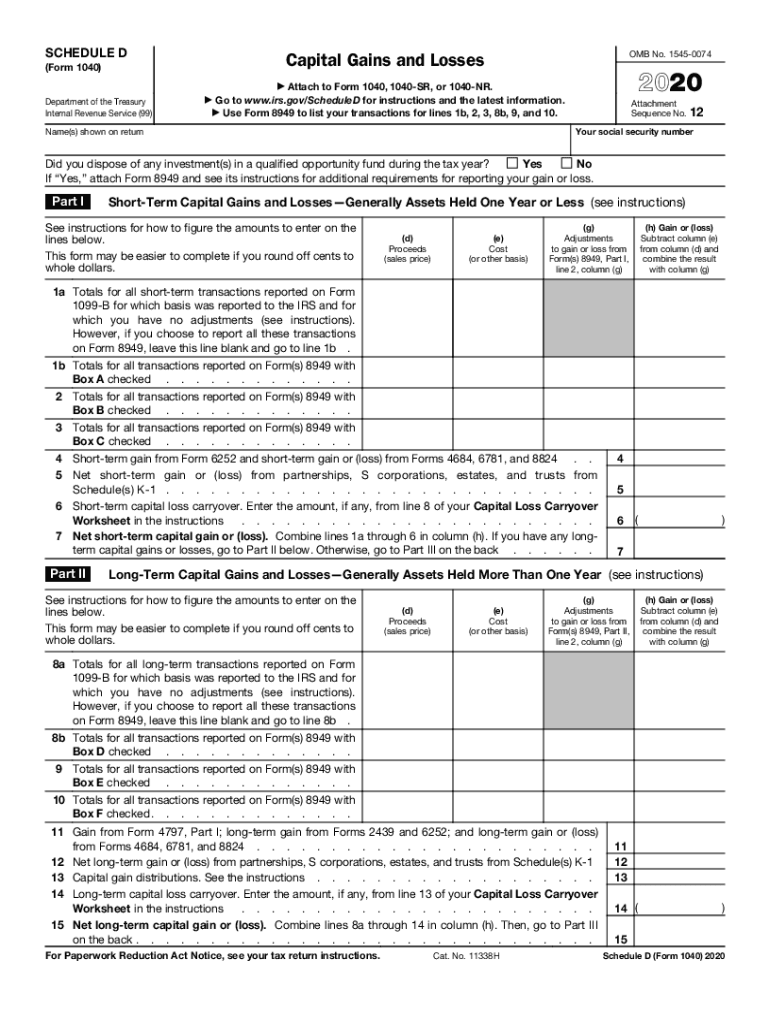

Source: www.pdffiller.com

Source: www.pdffiller.com

2020 Form IRS 1040 Schedule D Fill Online, Printable, Fillable, Blank, Below is information on the cash method, the accrual method, and. In most cases, this will be your.

Source: marthacmorgan.github.io

Source: marthacmorgan.github.io

2022 Form 1040 Schedule A Instructions, Your easy step by step instruction guide. For the latest information about developments related to schedule c and its instructions, such as legislation enacted after they were published, go to irs.gov/schedulec.

Source: portefoliomakeupbysofia.blogspot.com

Source: portefoliomakeupbysofia.blogspot.com

Irs 1040 Form C IRS Form 1040 Schedule C Download Fillable PDF or, For example, if you file form 1040, you’ll record the amount of your expense on a dedicated line (24b) on schedule c. Using tax software simplifies the filing process even further.

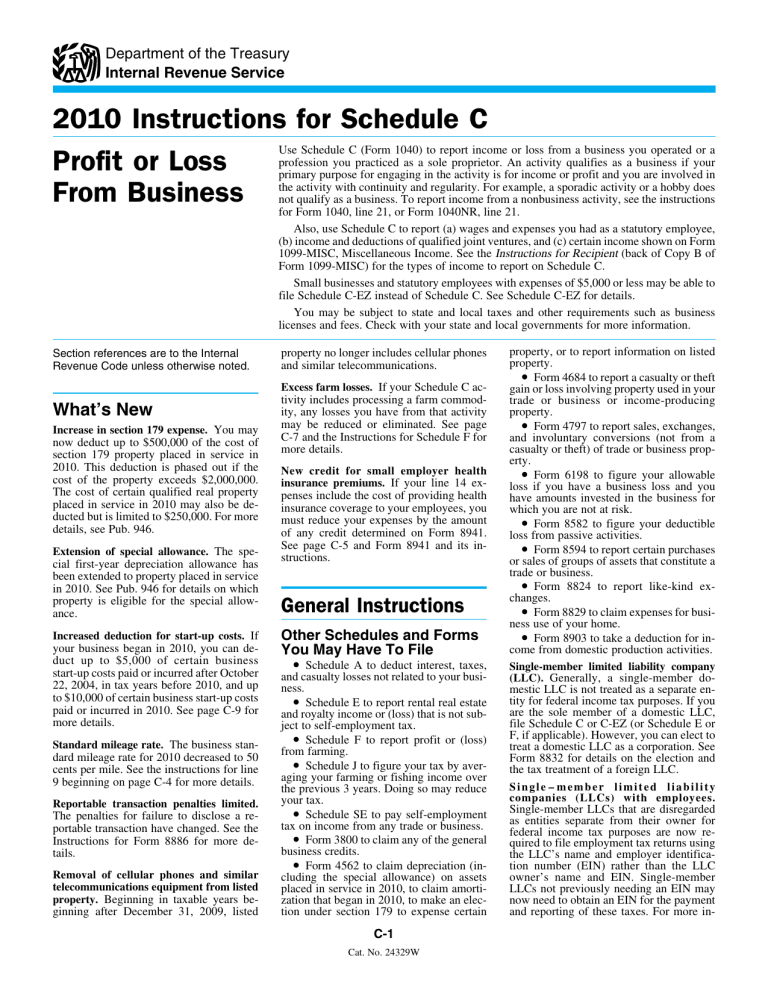

Source: studylib.net

Source: studylib.net

Instructions for Form 1040 Schedule C, Complete the research and development worksheet on. Profit or loss from business as a stand alone tax form calculator to quickly calculate.

Source: 1040-form-instructions.com

Source: 1040-form-instructions.com

1040 Form Instructions 2022, Who should file schedule c; For example, if you file form 1040, you’ll record the amount of your expense on a dedicated line (24b) on schedule c.

Source: 2023nascarschedule.pages.dev

Source: 2023nascarschedule.pages.dev

2023 Form 1040 Schedule C Nfl Schedule 2023, Per schedule c instructions, having a loss on schedule c, line 31, may limit the amount of loss you can deduct. Your easy step by step instruction guide.

Departing Alien Income Tax Return Department Of The.

Disclose the name and address of each source of income or each business entity with which you.

Go To Line 32 Before Entering The Loss On Line 31.

In this article, we’ll walk through irs schedule c, including: