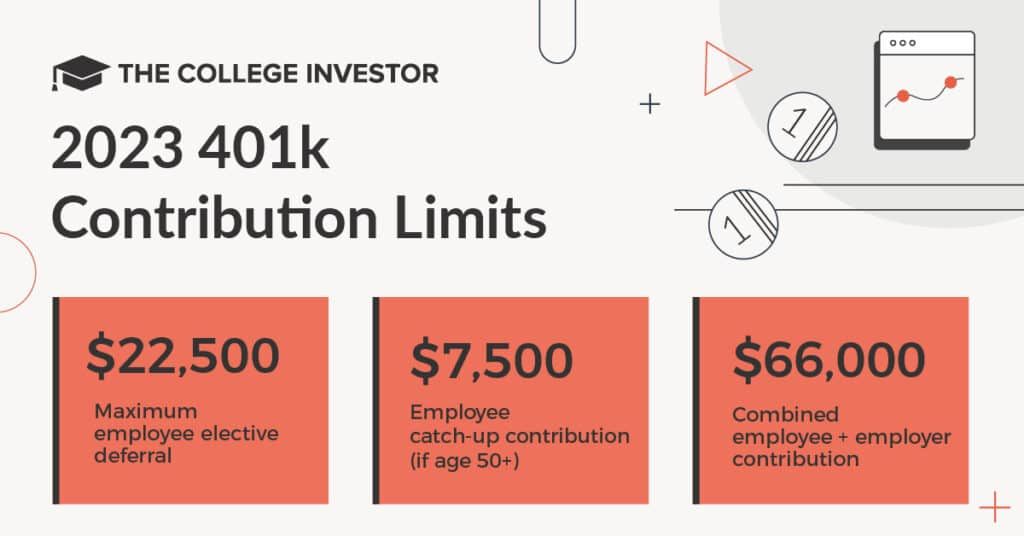

Max 401k Contribution 2024 With Catch Up Contribution. Employees can invest more money into 401(k) plans in 2024, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2024. Those 50 and older can contribute an additional.

Find out the 2024 limits, the irs relief, and the implementation. Find out how these limits have changed over the.

Max 401k Contribution 2024 With Catch Up Contribution Images References :

Source: andyysherry.pages.dev

Source: andyysherry.pages.dev

2024 Max 401k Contribution Limits Catch Up Contributions 2024 Hanni, Workplace retirement plan contribution limits for 2024.

Source: eranycharlene.pages.dev

Source: eranycharlene.pages.dev

Catch Up Contribution 401k 2024 Over 55 Faith Prisca, Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

Source: gwenniycaritta.pages.dev

Source: gwenniycaritta.pages.dev

401k Contribution Limits 2024 Catch Up Total Assets Valli Isabelle, Learn how much you can deposit into a roth 401 (k) in 2024, and how it compares to a roth ira and a traditional 401 (k).

Source: blairyrosemaria.pages.dev

Source: blairyrosemaria.pages.dev

Max 401k Catch Up Contribution 2024 Employer Match Mamie Rozanna, The limit on employer and employee contributions is $69,000.

Source: vitiayshanta.pages.dev

Source: vitiayshanta.pages.dev

Maximum 401k Contribution 2024 With Catch Up 2024 Rea Rebekah, In 2023, this rises to $22,500.

Source: ilkaypegeen.pages.dev

Source: ilkaypegeen.pages.dev

Max Tsp Contribution 2024 With Catch Up Contribution Limit Jaimie Leanna, Use a calculator to estimate your future.

Source: natkaychelsea.pages.dev

Source: natkaychelsea.pages.dev

2024 Max 401k Contribution Employer Match Adda Livvie, In 2022, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500.

Source: tonyeymerrili.pages.dev

Source: tonyeymerrili.pages.dev

Max Roth 401k Contribution 2024 Over 55 Eddy Nerita, The 401(k) contribution limit for 2024 is $23,000.

Source: prudyclarinda.pages.dev

Source: prudyclarinda.pages.dev

2024 401k Maximum Contribution Limits 2024 Daile Dulcine, Find out how these limits have changed over the.

Source: katyabvalene.pages.dev

Source: katyabvalene.pages.dev

2024 401k Catch Up Contribution Limits 2024 Over 60 Josey Mallory, Those 50 and older can contribute an additional.